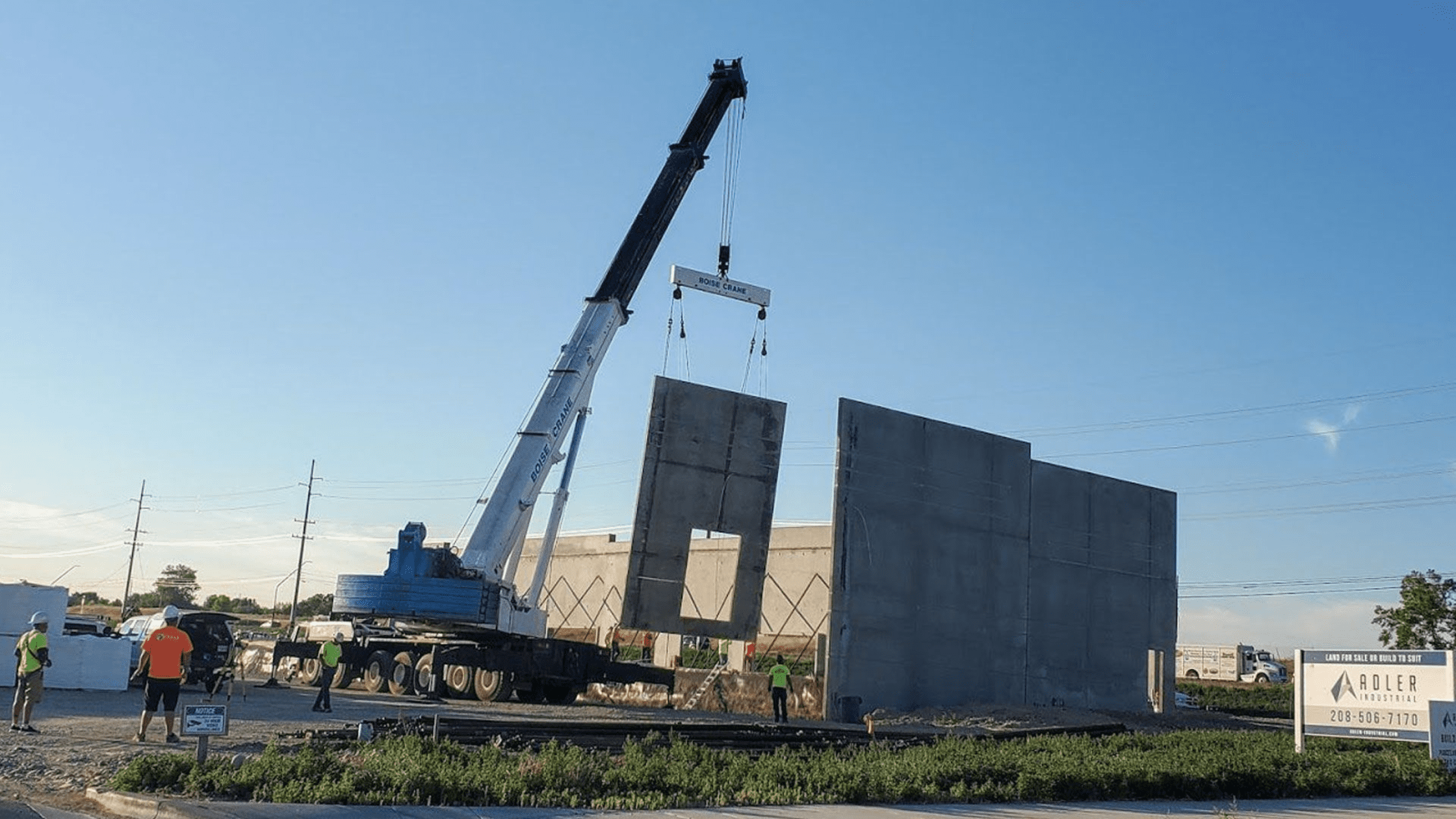

The industrial real estate market is undergoing rapid changes, and these shifts are opening up new opportunities for savvy investors. As consumer demands evolve, technology advances, and global supply chains adapt, the way businesses use industrial spaces is being redefined. For investors, staying informed isn’t just helpful—it’s essential to identify properties that will thrive in the future.

At Adler Industrial, we’ve seen how understanding emerging trends can turn a solid investment into an extraordinary one. In this blog, we’ll break down the key developments shaping industrial real estate and provide insights to help you navigate this dynamic landscape with confidence. Let’s uncover what’s driving the future of industrial investment property.

Rise of E-commerce and Logistics Facilities

The e-commerce boom is showing no signs of slowing down, and it’s revolutionizing industrial real estate. As online shopping becomes the norm, the demand for logistics and fulfillment centers continues to skyrocket. Warehouses equipped to handle large volumes of goods, particularly those with advanced automation, are in high demand.

Last-mile delivery facilities are a critical component of this trend. Consumers now expect faster delivery times, often within the same day. This has increased the need for strategically located warehouses near urban centers to fulfill these expectations. For investors, properties that cater to these logistical needs represent a lucrative opportunity, as businesses prioritize proximity to their customers.

At Adler Industrial, we’ve seen firsthand how e-commerce is driving the industrial market. From fulfillment hubs to last-mile delivery facilities, this trend is reshaping investment strategies and opening doors to high-yield opportunities.

Emphasis on Sustainability and Green Buildings

Sustainability is no longer a niche consideration in industrial real estate—it’s a key factor influencing tenant decisions and property values. Green buildings equipped with energy-efficient technologies are becoming increasingly popular among businesses looking to reduce their carbon footprint and operational costs.

Investors should pay attention to certifications like LEED (Leadership in Energy and Environmental Design), which indicate a property’s environmental performance. Features like solar panels, energy-efficient lighting, and advanced HVAC systems are no longer optional but expected in many markets. Properties that prioritize sustainability not only attract eco-conscious tenants but also command higher rental incomes and long-term value.

At Adler Industrial, we recognize the growing importance of green buildings and their impact on the market. Investing in sustainable properties today is an investment in the future of industrial real estate.

Advancements in Automation and Smart Warehousing

The rise of automation and smart technology is transforming industrial properties into high-tech hubs. Warehouses equipped with advanced robotics, IoT (Internet of Things) systems, and data-driven operations offer unparalleled efficiency and productivity.

For investors, properties that can accommodate these technologies are becoming increasingly attractive. These smart facilities often secure premium rental rates, as businesses seek out spaces that support their digital transformation goals. Additionally, as automation becomes more mainstream, the demand for tech-enabled industrial properties is expected to grow significantly.

At Adler Industrial, we help investors identify properties with the infrastructure to support these advancements, ensuring they’re well-positioned to capitalize on this trend.

Shift Toward Urban Industrial Spaces

As cities grow and delivery timelines shrink, industrial spaces are moving closer to urban centers. This shift toward urban industrial properties is driven by the need for rapid delivery and efficient supply chain operations.

Smaller distribution hubs located within or near cities are replacing traditional sprawling warehouses in remote areas. These urban properties are highly sought after, as they enable businesses to meet customer expectations for fast delivery.

For investors, this trend opens up new opportunities but also challenges traditional strategies. At Adler Industrial, we’re seeing an increased demand for properties that balance accessibility with urban convenience, making these investments a smart choice for the future.

Demand for Flex Spaces and Multi-Use Facilities

Flexibility is becoming a key feature in industrial real estate. Flexible industrial spaces that can serve multiple purposes—such as manufacturing, storage, and office use—are increasingly popular among tenants.

These multi-use facilities offer adaptability, which is crucial in today’s fast-changing market. Properties that allow tenants to adjust layouts or repurpose space provide a competitive edge, as businesses seek solutions that grow with them. Additionally, flexible leasing options attract a diverse range of tenants, reducing vacancy risks for property owners.

At Adler Industrial, we help investors identify and acquire properties that offer this level of versatility, ensuring they stay ahead in an ever-changing market.

The Impact of Global Supply Chain Reshoring

Recent disruptions in global supply chains have prompted many companies to rethink their sourcing and manufacturing strategies. Reshoring and nearshoring are gaining traction as businesses move operations closer to home to reduce risks and improve efficiency.

This trend is driving demand for industrial properties in strategic locations, particularly near ports, rail hubs, and manufacturing centers. Regions with strong infrastructure and skilled labor are becoming hotspots for industrial investment.

At Adler Industrial, we monitor these shifts closely, helping our clients identify properties in emerging markets that align with this trend and offer significant growth potential.

Growing Importance of Data Centers and Tech Infrastructure

The digital revolution is fueling an unprecedented demand for data centers and tech infrastructure. As businesses rely more on cloud computing, 5G networks, and data-driven operations, properties that support these technologies are becoming a critical part of the industrial real estate market.

Data centers, in particular, are highly specialized properties with immense growth potential. For investors, the opportunity lies in acquiring or developing spaces that cater to these needs, especially in tech-forward regions.

At Adler Industrial, we understand the unique requirements of these properties and guide our clients toward investments that capitalize on the booming tech sector.

Why Adler Industrial Stands Out?

The future of industrial investment property is dynamic, with trends like e-commerce growth, sustainability, urbanization, and technology reshaping the landscape. Staying informed about these shifts is essential for making strategic investment decisions and maximizing returns.

At Adler Industrial, we pride ourselves on helping investors navigate these changes with confidence. Our expertise in identifying high-potential properties ensures you’re always a step ahead in this evolving market.